10 year fixed mortgage rates are a financial commitment that has an extended period of time attached to it. If you don’t want to commit to a monthly expense, then the 10 year mortgage rates are a good choice for you. Am happy to announce to you that with a 10 year refinance rate you will be able to pay off your home in just 10 years. Not only that it is also a great opportunity for homeowners who want to pay off their loan sooner than later. Interestingly, most major mortgage lenders offer a 10-year mortgage.

Can I refinance a mortgage for 10 years?

Are you determined to pay off your mortgage early? If you are then refinancing into a 10 year mortgage will be a smart move. Refinancing a 10year mortgage will help you get a lower interest rate. The lower interest rate alongside a compressed repayment schedule will put you on the fast track to owning your home. 10 year mortgage refinances rates help you cut the amount of interest you will pay. Not only that, it will help you increase your monthly payment.

Who qualifies for 10 year arm rates?

A 10-year arm rate is the best choice for you if you can make a sizeable down payment and have more than enough income to cover the monthly payment. More importantly, you will need at least a 620 FICO credit score to qualify for this type of mortgage and you will also need a higher income to qualify for a 10 year mortgage. The good news about this is that lenders will look at other reliable sources of income beyond your monthly salary.

Is the current 10 year mortgage rates a good idea?

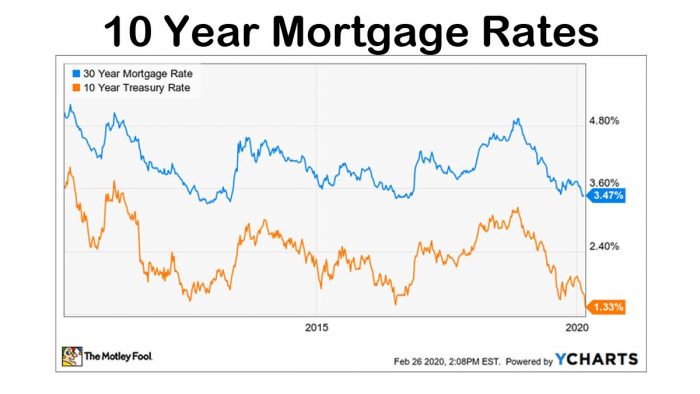

10 year mortgage rates is a good option for people who want to pay off their mortgage as soon as possible especially if you have the money to do so. If you can afford to make a large down payment and a high monthly payment, a 10 year fixed rate can save you on interest compared to that of a 30-year mortgage. A high monthly payment can be difficult for most people. So it is important to remember you have options, meaning that you can refinance to a 10year mortgage later when the income is available.

Advantages and disadvantages of a 10 year loan rates

This 10-year mortgage rate has disadvantages and advantages. It is important you know about them when applying for a 10year mortgage.

- One advantage is that your mortgage will be paid off much sooner.

- It also has less interest paid over the life of your loan.

- Lower interest rates compared to loans with longer terms.

- The advantage is that cash is tied up in your house and not made available to you.

- You can’t make lower monthly payments without refinancing.

Having the knowledge of the disadvantages and advantages of 10 over 30 mortgages you will be able to make a good choice. i hope this article was helpful.