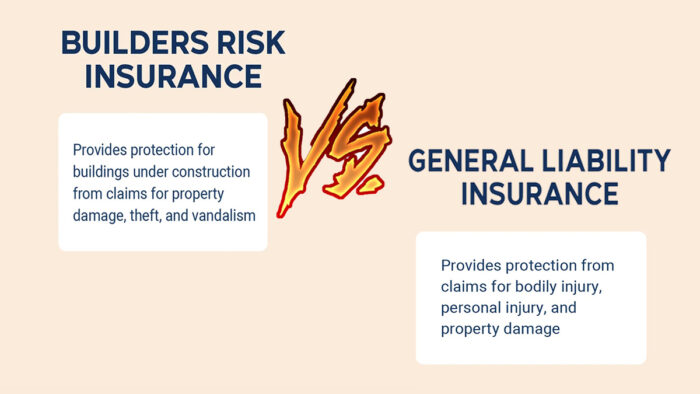

In the world of construction, insurance plays an important role when it comes to risk management. Builders risk insurance and general liability insurance are two basic forms of coverage that offer protection against different construction risks and hazards.

What’s the difference between builders risk insurance and general liability insurance? is one of the questions that property owners, contractors, and developers ask. If you are curious and you need answers, read to the end of this guide to find what you are looking for.

What is Builders Risk Insurance?

Builders risk insurance, also known as course of construction insurance, is meant to safeguard projects and buildings that are undergoing construction. What’s more, this form of insurance offers coverage for the structure of the building, fixtures, equipment, and materials used for the renovation or construction of the building.

What Does Builders Risk Insurance Cover?

Here is what builders risk insurance covers:

- Additional expenses.

- Equipment on-site.

- Materials and supplies.

What Does It Not Cover?

These are the exclusions of a builders risk insurance policy:

- Employee theft.

- Normal wear and tear.

- Government action.

- Riots or acts of war.

- Flood damage.

- Mechanical breakdown.

- Earthquake damage.

Who Needs a Policy?

You might want to consider getting a builders risk insurance policy if you fall into or fall under any of the categories mentioned below:

- Property owners are working on a construction project.

- General contractors.

How Much Does Builders Risk Insurance Cost?

The cost of builders risk insurance can differ and is affected by various factors. Some of them include the type of construction, project size, coverage chosen, and location. However, it costs from 15 to 4% of the whole construction cost.

What is General Liability Insurance?

General liability insurance offers protection against injuries, accidents, negligence claims, and other liability issues that can take place during operations. It is also helpful for safeguarding businesses against unexpected damages and expenses from lawsuits.

What Does General Liability Insurance Cover?

Here are the coverage options you can access with a general liability insurance policy:

- Bodily injury.

- Legal defense costs.

- Property damage caused to third parties.

- Medical payments.

- Personal and advertising injuries.

What Does It Not Cover?

Just like other types of insurance, there are scenarios in which general liability insurance will not be applied, and they include:

- Intentional property damage.

- Employee injuries.

- Professional mistakes.

- Intentional acts.

Who Needs a Policy?

- Contractor companies.

- Construction companies.

- Any business that has to do with connecting with clients or the public.

How Much Does General Liability Insurance Cost?

The average cost of a general liability insurance quote is usually between $400 and $600 per year for small business owners. On the other hand, there are various factors that affect the cost of this type of insurance, and they include coverage limits, business size, location, and industry.

Builders Risk Insurance vs General Liability Insurance: What’s the Difference?

The major difference between builders risk insurance and general liability insurance is that the former provides coverage for a damage caused to a construction projet, while the latter provides coverage for damage to someone else’s property. For a better understanding of the distinctions between these two insurance types, here is a table:

| Aspect | Builders Risk Insurance | General Liability Insurance |

| Coverage Type | Property insurance | Liability insurance |

| Purpose | Protection of investment in equipment, materials, and property for construction projects | Protection against property damage, bodily injury, and lawsuits |

| Typical Policy Term | Usually throughout the project’s duration | Usually annual |

| Who Needs It | Developers, general contractors, and property owners | Contractors and subcontractors |

| Factors Affecting Cost | Type of construction, total project value, construction duration period | Risk exposure, coverage limits, and type of business. |

| Cost Range | 1% to 4% of construction cost | $400 to $600 per year for small businesses |

This table illustrates the major differences between this two insurance policies and will help you choose which insurance works best for you.

FAQs

Can builders risk insurance replace the need for general liability insurance on a construction site?

No, builders risk insurance does not work as a replacement to cover the need for general liability insurance when working on a construction site. This type of insurance pays more attention to the materials and the construction project itself. General liability insurance, on the other hand, covers damages to others and bodily injury.

If I am a contractor, do I need both builders risk and general liability insurance?

Certainly, as a person working as a contractor, it is suggested to purchase both forms of insurance, as general liability covers damages and injuries during operations while builders risk covers the structure itself and construction material.

Can additional coverage be added to either policy based on project needs?

Yes, both insurance policies allow policyholders to include additional riders or endorsements based on the project’s risks and needs.