OPay stands out as a versatile and user-friendly platform, offering a myriad of services to streamline financial transactions. Among its array of features, one noteworthy capability is the ability to lock money on OPay, providing users with an additional layer of control and security over their funds.

By locking money on OPay, you can prevent accidental or impulsive spending. This feature is especially useful for individuals who are budgeting or saving for specific goals, ensuring that allocated funds remain untouched until needed.

In this guide, we will navigate through the simple yet crucial steps to effectively lock money on OPay, ensuring a secure and tailored financial management experience.

What is OPay Fixed Deposit?

Opay fixed deposit is a savings plan where you deposit a fixed amount of money for a specified period. And in return, you earn interest on that deposit. The interest is not paid out periodically (like monthly or quarterly) but is instead paid out in full on the due date, along with the initial amount you deposited.

So, if you choose to participate in Opay’s fixed savings plan, you lock in your money for a certain duration. And at the end of that period, you receive both the initial amount you deposited and the accumulated interest. This type of savings plan is often referred to as a fixed deposit. It provides a way for individuals to earn a return on their savings over time.

OPay fixed deposits are available in two modes: lock and unlock.

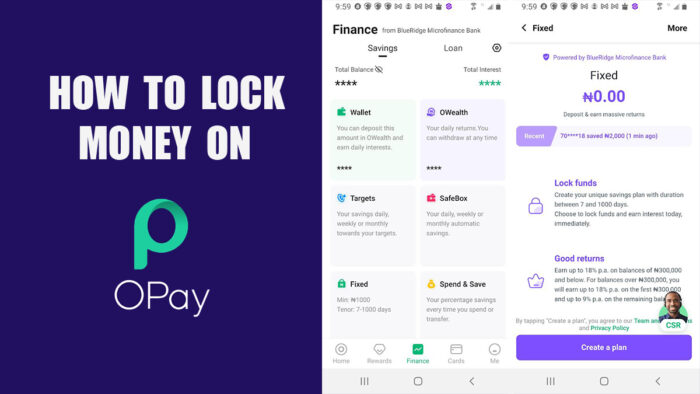

How to Lock money on OPay

If you are new to OPay, you may be wondering if its fixed deposit feature is really safe. Many users express concern as they are hesitant to take risks. As previously mentioned, OPay’s fixed money lock feature is designed for secure savings and interest accrual, making it a reliable choice. The steps below show you how to lock your money on OPay.

- Launch the OPay app and login to your OPay account using your existing credentials.

- Click on Finance in the footer navigation.

- Select Fixed on the next window.

- Click on Create a Plan.

- Select an investment duration period: 7–60 days, 61–180 days, 181-364 days, or 365–1000 days. Note that the longer your duration, the higher the interest you earn.

- Then fill in the following: name, saving amount, and payback date.

- Click next

- Then you will be shown a payment.

- Turn on a display sentence to lock your money.

- Then click on Payment once you are done.

When you create a plan and decide to lock your money in on OPay, you will earn interest. Meanwhile, you won’t be able to withdraw it until the due date of your investment.

For instance, if you lock your money for the duration of 7 days and decide to withdraw it on the fifth day of withdrawal, your money will still remain locked until it gets to the seventh day.

FAQs

Why Should I Lock Money on OPay?

OPay Lock Fixed Deposit is a plan that is only available on mobile phones and gives users interest on a fixed savings deposit. The following are the reasons why people should lock money on OPay:

- Locking your money on OPay adds an extra layer of security to your funds. It acts as a safeguard against unauthorized access, providing peace of mind for users concerned about the safety of their digital assets.

- Interest can be earned according to the duration of the investment.

- It is a global saving product for users.

- If you’re working towards a financial goal, locking money on OPay helps you stay disciplined. It creates a clear separation between your regular spending and your savings, making it easier to track progress and avoid dipping into your designated savings pool.

- Locking money on OPay adds an extra layer of protection against potential fraud. In the event that your account is compromised, the locked funds remain secure, mitigating the risk of financial loss.

Locking money on OPay doesn’t really mean that your account is frozen or that you can make use of your money in your account, but it serves as an improvement in earning interest in the form of money, and it’s been added up to your fixed deposit. So once this is done, you earn more cash when you withdraw.

What Happens if I Lock My Money on OPay?

Locking your money on OPay doesn’t mean that it will be locked permanently or frozen. It is simply a plan that gives you interest on the fixed deposit and can’t be withdrawn. No matter what happens, you will have to wait until the due date for withdrawal.

Can I Withdraw My Money From OPay Fixed Deposit Before the Due Date?

If you choose to use OPay fixed deposit, it will be impossible to withdraw your money before the due date. The duration of your investment determines your earned interest and when to withdraw your money. So withdrawing money before the due date is impossible.

But if you didn’t turn on the locked funds icon, you will be able to withdraw your money before the due date. But note that if you withdraw your money too early before the due date, you will lose most of your interest.

How Much Interest do I Earn With OPay Fixed Deposit?

The interest you earn on OPay fixed savings varies according to the actual duration of your payback time. For instance, if you deposit a fixed savings of a thousand naira for a duration of 7 days, the interest will vary compared to the duration of 14 days. So, there is no fixed interest when using OPay fixed deposit.