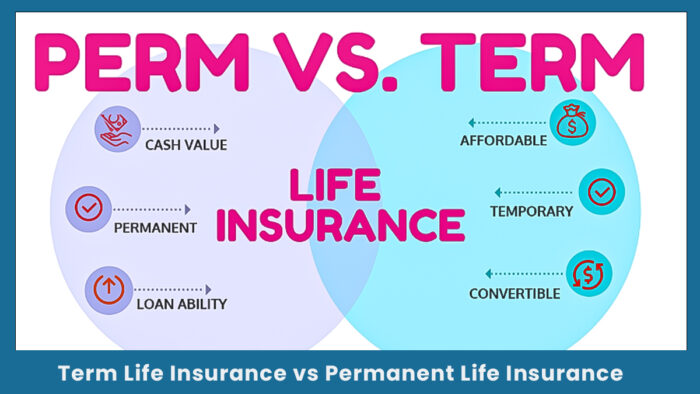

Term Life Insurance vs Permanent Life Insurance: When deciding between term life insurance and permanent life insurance, it’s important to understand the key differences. Term life insurance offers coverage for a specific period, such as 10, 20, or 30 years. It’s typically more affordable and provides a death benefit to beneficiaries if the policyholder passes away during the term. However, once the term expires, so does the coverage, and there is no payout if the policyholder outlives the policy.

In contrast, permanent life insurance provides lifelong coverage as long as premiums are paid. This type of insurance often includes a cash value component that grows over time. Permanent life insurance is more expensive, but it offers added benefits such as potential access to cash value or a guaranteed death benefit. Understanding these differences can help you choose the best option based on your financial needs.

How Term Life Insurance Works

When you buy a term life insurance policy, the insurance company sets your premium based on the value of the policy and personal details such as your age, gender, and overall health. Other factors that may affect the cost include the company’s business expenses, how much it earns from investments, and the life expectancy for your age group. In some cases, you might need to take a medical exam.

The insurer may also ask about your driving history, current medications, smoking habits, job, hobbies, and your family’s medical background. If you pass away during the term of the policy, the insurer pays the full death benefit to your beneficiaries. This payout is usually not taxed and can be used to cover funeral expenses, medical bills, personal loans, mortgage payments, or any other financial needs. However, your beneficiaries are not required to use the money to pay off your debts.

If you outlive your term life insurance policy, there will be no payout. Some insurers allow you to renew the policy once it expires, but the cost will be updated to reflect your current age, which usually means higher premiums.

Types of Term Life Insurance

There are several types of term life insurance. The best one for you will depend on your personal needs and future plans. Most term policies range from 10 to 30 years, though a few insurers offer terms up to 35 or 40 years.

- Level Term or Level-Premium Policy: This policy keeps both the premium and the death benefit fixed throughout the term. It’s the most common type of term insurance. Premiums are set to cover the rising cost of insurance as you age, so they’re typically higher than yearly renewable plans at the start.

- Yearly Renewable Term (YRT) Policy: This type renews each year without requiring new proof of health. However, the premium increases annually as you get older, which can eventually make it very expensive.

- Decreasing Term Policy: Here, the death benefit drops every year following a preset schedule, while the premium remains the same. This is often used with a mortgage, where the insurance amount decreases alongside your home loan balance.

Permanent Life Insurance

Permanent life insurance is a type of policy that provides lifelong coverage, as long as the premiums are paid. Unlike term life insurance, which only lasts for a specific period, permanent life insurance remains active for your entire life. It also includes a cash value feature that grows over time and earns interest. This growth happens on a tax-deferred basis, meaning you won’t pay taxes on it while it’s building up inside the policy.

Because it offers both lifelong protection and a savings element, permanent life insurance usually costs more than term insurance. The cash value can be used in several ways. Some people use it to borrow money, supplement retirement income, or help cover future premium payments.

How Does Permanent Life Insurance Work?

Permanent life insurance provides coverage for your entire life, as long as you keep up with your premium payments. Unlike term life insurance, which only lasts for a specific period, permanent policies do not expire and also include a cash value component that grows over time.

This cash value can be used while you’re still alive. You can borrow from it through a policy loan or withdraw part of it to help with needs like medical bills or a child’s education. However, any loan from the cash value comes with interest. If the total amount of unpaid interest and the loan balance ever becomes greater than the policy’s cash value, your coverage may end.

One of the major advantages of permanent life insurance is how the cash value grows tax-deferred. This means you won’t owe taxes on the earnings as long as the money stays in the policy. In some cases, you can even take out part of the money without paying taxesespecially if the amount you withdraw is equal to or less than what you’ve paid in premiums. Still, any money taken from the policy will reduce the death benefit left to your beneficiaries.

Types of Permanent Life Insurance

The two most common types of permanent life insurance are whole life and universal life. Whole life insurance offers fixed premiums and a guaranteed rate of return on the cash value. Universal life insurance provides more flexibility, allowing you to adjust your premiums and death benefit as needed. It also earns interest based on current market rates.

Benefits of Term Life Insurance

Term life insurance is especially appealing to younger adults with growing families. It offers high coverage amounts at a much lower cost compared to permanent life insurance.

- Parents can use it to ensure financial security for their children in case of an unexpected death.

- It’s useful for those who only need coverage for a specific time, like until the kids are independent or the mortgage is paid off.

- Older adults can also benefit from term coverage, but premiums will be more expensive if you apply later in life.

- Each insurer sets an age limit for new term life policies, usually between 80 and 90 years old.

Term Life Insurance vs. Permanent Life Insurance

Term Life Insurance vs Permanent Life Insurance: There are key differences between term and permanent life insurance. Choosing the right one depends on your goals and financial situation.

- Cost of Premiums: Term life is more affordable and offers higher coverage for a lower cost. Permanent life insurance, like whole life, is more expensive but lasts your entire life.

- Coverage Availability: Unless your term policy has guaranteed renewability, the insurer might refuse to renew it if you develop a serious illness. Permanent insurance keeps you covered as long as you keep paying the premiums.

- Investment Value: Permanent policies often include a savings or investment feature that builds cash value over time. Some even pay dividends. You can borrow from this cash value, and it comes with tax benefits.

However, these policies tend to grow more slowly than traditional investments, and administrative fees can reduce your returns. This is why some advisors suggest buying term insurance and investing the difference elsewhere.

Advantages and Disadvantages of Permanent Life Insurance

- Permanent life insurance offers lifetime coverage, giving your loved ones a guaranteed payout as long as you keep up with the payments.

- It includes a savings feature that builds cash value over time and grows with tax advantages.

- You can access the cash value by borrowing or withdrawing funds while the policy is active, which can be helpful during financial emergencies.

- On the downside, this type of insurance is more expensive compared to term life policies.

- If you miss payments or cannot keep up with the cost, the policy may end and leave you without coverage.

- Using the cash value during your lifetime can reduce the amount your beneficiaries receive later.

Which Is Better: Term or Permanent Life Insurance?

Term life insurance is more affordable and covers you for a specific period. Permanent life insurance lasts your entire life and also builds cash value. The right choice depends on your budget and long-term needs.

Can You Cash Out Permanent Life Insurance?

Yes, you can. After some years, you may borrow from the policy, withdraw from the cash value, or surrender the policy entirely. If you surrender it, you might have to pay surrender fees or taxes on the amount withdrawn.

The Bottom Line

Permanent life insurance offers lifetime protection and includes a savings feature that grows tax-deferred. You can use this cash value while alive, but premiums are higher. Term life insurance, on the other hand, is more affordable and provides coverage for a set number of years, making it a great option for those looking for temporary protection with lower costs.