Navigating the world of life insurance can be daunting, with countless options available to protect your loved ones financially. Amidst the array of choices, two prominent contenders stand out: term and whole life insurance. Understanding the differences between these two policies is crucial for making informed decisions about your financial future.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that offers financial protection for a particular or set period, such as 10, 20, or 30 years. It pays out death benefits to the beneficiaries of the policyholder if he or she passes away within the term of the quote.

Without a doubt, term life insurance is usually chosen by people because of its affordability and simplicity. Unlike whole life insurance, it also has higher coverage amounts for lower premiums. However, this type of insurance does not collect or gather cash value.

What Does Term Insurance Cover?

These are the basic inclusions this type of policy should have and provide:

- Debts and loans.

- Income replacement.

- Death benefit.

- Funeral expenses.

- Living expenses.

- Education costs.

Thus, with this type of life insurance, your insurance company will be offering coverage for all of the things mentioned above.

What Does It Not Cover?

Here are the exclusions involved with term life insurance and the scenarios that it will not be responsible for:

- Illegal application.

- There is no death benefit payout after the term expires.

- Serious illness.

- Suicide within the first 2 years.

- Disability income.

- Cash value accumulation.

- Long-term care costs.

It is important to understand what is covered and not covered by an insurance policy before applying, and term and whole life insurance are not exceptions.

Who Needs a Policy?

If you fall into any of these categories, you need a term insurance quote:

- If you want temporary coverage for a specific period.

- Have a particular debt you want covered if you die.

- If you want your children’s college tuition covered.

- If you want affordable coverage.

- Don’t want to get cash value through life insurance.

- If you are considering permanent life insurance but cannot afford it at the moment.

If you want any or all of the following, then I strongly advise you to get or apply for a whole life insurance policy.

What is Whole Life Insurance?

On the other hand, whole life insurance provides lifetime coverage to policyholders just as long as they pay for premiums. This type of insurance has an investment part called the cash value. This grows at a guaranteed rate as time passes and acts as a form of investment or savings. However, whole life insurance has higher premiums than term life insurance, but there is security throughout your lifetime.

What Does Whole Life Insurance Cover?

Here are the situations and events in which your whole life insurance policy will come in handy. They include:

- Estate planning.

- Death benefit.

- Lifetime coverage.

- Cash value accumulation.

So, with a whole life insurance policy, you will receive coverage for all of the following mentioned above.

What Does It Not Cover?

Here are the exclusions and situations for which whole life insurance will not offer coverage:

- Immediate full coverage.

- Wealth building.

- Certain conditions and riders.

- High returns on cash value.

None of the following will be covered by this insurance except if an insurance company offers coverage for them.

Who Needs a Policy?

I suggest that you choose whole life insurance if you:

- If you want to fund a life insurance trust.

- If you want a lifetime-lasting quote.

- Afford higher premiums comfortably.

- Build a guaranteed cash value.

- If you have a dependent who needs lifelong financial support.

- If you want a death benefit that will cover funeral expenses.

If you want any or all of the following, then I strongly advise you to get or apply for a whole life insurance policy.

Term vs. Whole Life Insurance: What’s the Difference?

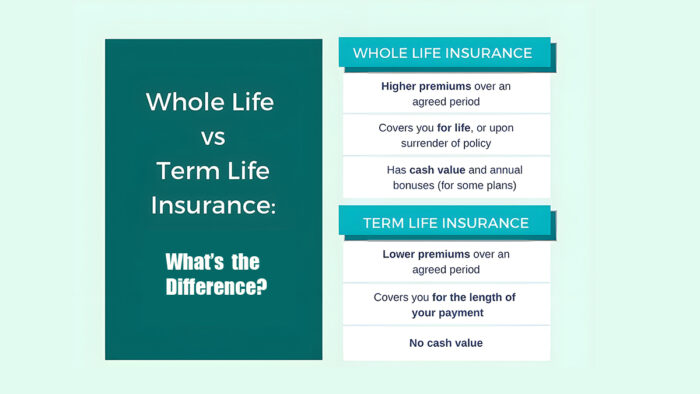

Term insurance provides coverage for a specific period, offering a death benefit if the insured passes away during that time, while whole life insurance provides coverage for the entirety of the insured’s life and includes a savings component with cash value accumulation.

Since you have found out what term and whole life insurance mean, what they cover, and what they don’t, here is a table illustrating the differences between these types of life insurance policies:

| Policy | Term Life Insurance | Whole Life Insurance |

| Cash Value | No cash value | Cash value increases at a particular rate set by the insurance company. |

| Death Benefit | Normally level but decreasing death benefits are accessible. | Normally level but graded death benefits are available. |

| Policy Length | 1, 5,10, 15, 20, 25, or 30 years. | Coverage lasts your whole life and expires at a particular age, like 95 or 100. |

| Premiums | Stay level through the length of the policy. | Stay level throughout the length of the policy. |

| Dividends | No dividends | Accessible through engaging quotes or policies. |

| Cost | Most affordable | More expensive |

| Surrender Value | There is no surrender value if you terminate your policy | There is a surrender value if you terminate your policy. |

With this, you will get a better picture of how term life insurance and whole life insurance differ from each other. In conclusion, choosing between term and whole life insurance depends on factors like investment choice, your needs for coverage, and individual financial goals.