What are the factors that affect life insurance rates? In the ever-evolving landscape of insurance, having an understanding of factors that affect the rate of life insurance is essential for those who seek protection for their loved ones as well as their financial future.

This article aims to shed light on factors affecting insurance rates, ranging from age, health status, coverage options, and other variables that can impact the cost of life insurance rates.

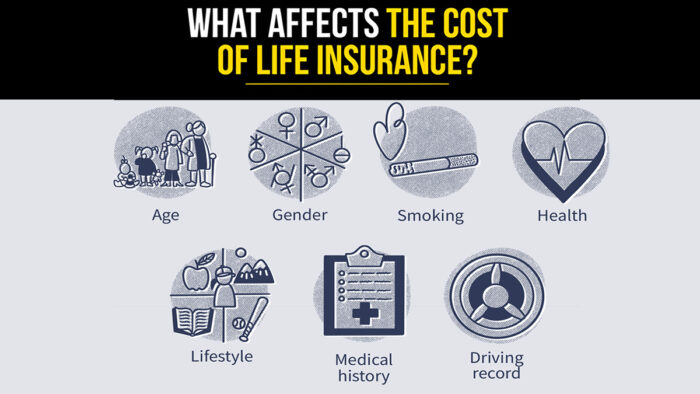

What Factor Affect Life Insurance Rates?

The following factors affect life insurance rates:

• Age

Age is one of the primary factors that affect life insurance rates. Before providing life insurance, insurance companies will assess your current age and life expectancy. Individuals who are younger are less likely to die, which means that you will have lower monthly life insurance quotes.

Older people’s term periods will be shorter. Those interested in a cash-value life insurance policy should be on the lookout for insurance companies that have a maximum age of 85 or younger.

• Gender

Gender is also considered to be among the top factors that affect life insurance premiums. The life expectancy for females is longer than that of males. As a result of this life expectancy, males and females generally pay less for life insurance, while men pay more.

• Health Status

Your health status also adversely affects your life insurance rate. Policyholders with significant health conditions are considered to have a high risk owing to the fact that they are more likely to request a payout from their life insurance sooner than expected.

Common health factors that affect the insurance rate include high blood pressure and hypertension, high cholesterol, diabetes, sleep apnea, anxiety, and depression. A family’s medical history, height and weight, risky behaviors, and other health-related issues have a significant impact on insurance rates.

• Smoking

Frequent usage and consumption of cigarettes can affect your insurance rate when purchasing life insurance. Ordinary use of nicotine can include your policy for “smoker” rates, such as smokeless tobacco, vaping, pipes, chewing tobacco, nicotine patches and gum, e-cigarettes, etc.

Although marijuana users can purchase non-smoking rates if the usage is occasional, you should prepare to settle the rates associated with it, as it often comes with higher rates.

• Family Medical History

This is yet another factor that affects insurance rates. One of the questions your insurance provider will ask is about your family medical history. So don’t be surprised when you are asked.

Your family’s medical history adversely has an effect on your insurance rate, especially with medical histories such as cancer (breast, colon, prostate, pancreatic, and others), congenital heart disease, melanoma, and cardiovascular disease.

• Occupation and Hobbies

Insurance providers will ask questions pertaining to the policyholder’s lifestyle, occupation, and hobbies. If your occupation involves hazardous duties, it would affect your insurance policy, and you would have to pay higher rates for more coverage.

In addition, there are certain hobbies that are considered risky, like scuba diving, skydiving, and piloting a plane, which could attract higher rates. It is essential to purchase life insurance from insurance companies that offer good rates for certain occupations and hobbies.

• Driving Record

Drivers who have a history of driving under influence (DUI) or who have been penalized for reckless driving that led to the suspension of their driver’s license are usually considered to be at higher risk. If you have these driving records, you are more likely to pay higher rates on your life insurance.

• Criminal Record

Individuals with certain criminal records will most likely not be offered a life insurance policy. Criminal records adversely have an effect on your life insurance quotes and even your eligibility.

Those awaiting trial, serving a jail term, or individuals on probation or parole will likely get a rejection from life insurance companies. You can also be denied if you have multiple criminal records, like murder or high-end organized crime.

• Coverage Length and Amount

This is also one of the factors that affects life insurance rates. Coverage length and cost automatically determine the specific coverage of your life insurance.

The least expensive type of life insurance is term life insurance. Universal life is way more expensive than term life, and whole life insurance is the most expensive of the types of life insurance. The type of life insurance you purchase will determine the coverage options and the amount you will be required to pay.

How to Shop for Life Insurance

Individuals who are interested in purchasing life insurance policies should first determine how much life insurance they need. They should also take into consideration the type of policy that aligns with their specific needs and interests. Be on the lookout for factors like term life and universal life insurance.

Afterwards, shop for the best life insurance quotes from different insurance companies. Compare the cost, coverage options, company’s reputation, and financial strength ratings. Making comparisons enables you to select the best life insurance company.