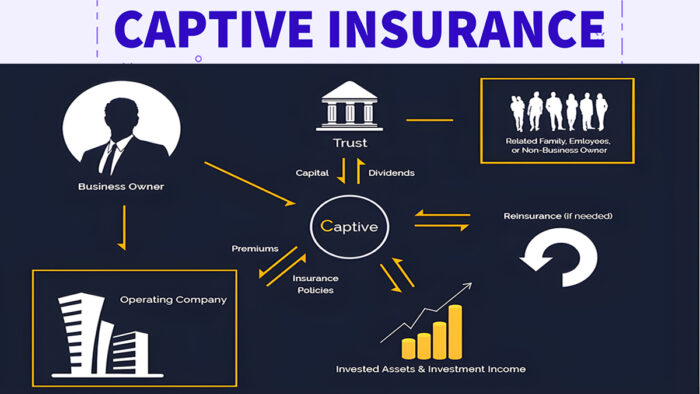

Captive insurance is typically an alternative to self-insurance that allows a company to establish their own insurance company instead of having to purchase directly from traditional insurers. This type of insurance policy is often used by groups and large corporations that seek protection against potential risks.

The primary purpose of this insurance policy is to avoid using traditional insurers, which may not meet the specific needs and structure of the company.

Establishing their own insurance company often comes with a lot of benefits, such as a reduction in costs, direct access to reinsurance markets, increased cash flow, and coverage of difficult risks.

Types of Captive Insurance

There are different types of captive insurance designed to meet the needs and structure of a company, some of which include:

• Pure captive

Pure captive is also known as single-parent, and it is one of the best choices for companies that need coverage for multiple risks. It is often owned by a single company that provides captive coverage for insurers.

• Group captive

It is designed to meet the needs of small and midsize companies. It is made up of several businesses that come together to obtain coverage beyond the ones provided by traditional insurers.

• Rental captive

Rental captive permits a captive insurer to rent its services to another organization in return for a fee, allowing the organization to enjoy some benefits without the cost associated with forming and managing one on their own.

• Association captive

This is yet another type of captive insurance that is owned by several companies. However, the companies that make up this type of captive insurance are often members of the same association, hence the name “association captive.”

Pros

• Lower insurance costs

One of the primary benefits of captive insurance is that, over time, it leads to potential cost savings. The parent company will enjoy the benefit of a low insurance cost, thereby making it more accessible and feasible.

• Customized Coverage

It features customized coverage that enables the parent company to tailor insurance coverage to its risk profile and specific needs, ultimately providing greater control and flexibility.

With this option, the parent company can choose the type of coverage they want and also have a better understanding that transcends just the coverage alone.

• Tax benefits

It also offers tax advantages, such as deductions for insurance premiums paid and tax deductions on certain underwriting profits.

• Long-term stability

It is capable of providing stability and continuity for coverage, adversely helping to reduce reliance on other insurance companies for coverage. It also helps to reduce potential disruptions in coverage.

Cons

• Initial setup costs

The cost of establishing a captive insurance company is usually expensive, owing to the fact that there are significant upfront costs that need to be settled before establishing one. The initial set-up cost often makes it less suitable for smaller companies, as they may not be able to cater for the legal and regulatory expenses needed to establish this insurance policy.

• Regulatory compliance

It is limited to certain requirements that attract administrative expenses and demand total compliance, which could lead to difficulty. Companies are subjected to compliance that might outweigh their level of tolerance and policy.

• Limited market access

It may not grant access to normal coverage options and reinsurance markets, which may eventually restrict the parent company’s ability to transfer certain risks effectively.

FAQs

Why is it advisable to choose captive insurance over traditional insurance?

There are several reasons why a company may decide to choose captive insurance over traditional insurance. Companies that seek great control over risk management, potential cost savings, and customized coverage often opt for captive coverage because of the benefits it offers. Captivate insurance also offers tax benefits, which makes it a wise option for companies.

What types of risks are covered by a captive insurance company?

Captive insurance companies often provide coverage for a vast array of risks, like property damage, professional indemnity, liability, and several other types of coverage.

Can any company establish a captive insurance company?

Yes, another company can decide to establish a captive insurance company. There’s really no harm in doing that.

However, the company should be on the lookout for certain factors, such as the company’s risk profile, financial resources, regulatory terms, and the long-term strategies of the captive insurance company. This would help you make informed decisions as to whether to buy the captive insurance company or not.

Is captive insurance suitable for small businesses?

Well, this depends on whether the small business owner will be able to cover the cost associated with captive coverage. Although captive insurance offers benefits for small businesses, it usually comes with a high initial setup cost and certain regulatory requirements that can make it unsuitable for small businesses compared to larger ones.