Instant life insurance is a type of coverage that allows individuals to obtain insurance quickly without the need for medical underwriting or a waiting period. This option is ideal for those who require immediate life insurance or have pre-existing conditions.

Instant life insurance provides a swift and convenient way to obtain coverage without the need for a medical examination. By streamlining the application process, it offers quick decisions on coverage eligibility, often within minutes or days.

This type of policy appeals to individuals seeking immediate protection for their loved ones without the delays associated with traditional life insurance.

While premiums may be higher due to the reduced underwriting scrutiny, the convenience of instant coverage makes it an attractive option for many. With this insurance policy, securing financial protection for the future becomes accessible and hassle-free.

Benefits of Instant Life Insurance

Instant life insurance offers several benefits that make it an attractive option for individuals seeking quick and convenient coverage without the traditional hurdles of medical exams and extensive underwriting processes. Here are the key benefits of this insurance policy:

• Speed and convenience

It provides quick coverage, with some insurers offering approval within minutes of application submission.

The online application process is user-friendly, allowing applicants to receive quotes and complete the process without the need for paperwork or agent assistance.

• No medical exam is required

It does not typically require a medical exam, making it easier and faster to obtain coverage compared to traditional policies that involve extensive underwriting processes.

• Immediate coverage

Approved applicants can have coverage go into effect on the same day, providing immediate financial protection for beneficiaries in case of unexpected events.

Beneficiaries can be named right away, ensuring that financial obligations and final expenses can be addressed promptly after the policyholder’s passing.

• Flexibility and customization

Instant issue policies offer flexibility in adjusting coverage amounts as needed without going through another lengthy underwriting process.

Applicants can choose from various policy options to tailor coverage to their specific lifestyle needs and budget requirements.

• Reduced risk of unknown conditions

It reduces the risk of unknown health conditions affecting coverage eligibility, as comprehensive underwriting processes in traditional policies may uncover issues that could prevent coverage approval.

Also, it provides a convenient and efficient way to obtain coverage quickly, offering benefits such as speed, convenience, no medical exams, immediate coverage, flexibility, and a reduced risk of unknown conditions impacting eligibility. These advantages make it a viable option for individuals who prioritize swift access to financial protection for their loved ones.

Consideration and Limitations

When considering instant life insurance, it is crucial to be aware of certain limitations and factors that may impact its suitability for your needs. Here are the key considerations and limitations based on the search results:

Considerations

- Coverage Amounts: It may offer lower coverage amounts compared to traditional policies, which could be a limitation for individuals with significant financial obligations.

- Speed of Approval: It provides quick approval decisions, making it ideal for those who need immediate coverage without delays.

- No medical exam: The absence of a medical exam simplifies the application process, appealing to individuals who prefer a faster and more convenient way to obtain coverage.

- Flexibility: It can offer flexibility in adjusting coverage amounts and options to suit individual needs and budget requirements.

Limitations

- Eligibility Criteria: It may have specific eligibility criteria based on age and health status, limiting coverage options for older individuals or those with pre-existing conditions.

- Coverage Options: It may have fewer customization options compared to traditional policies, potentially limiting the ability to tailor coverage to specific needs.

- Premium Costs: Due to the streamlined underwriting process, instant life insurance policies may come with higher premium costs compared to traditional policies that involve more extensive assessments.

- Policy Features: Some instant life insurance policies may have limitations in terms of available riders or additional features, which could impact the comprehensiveness of the coverage offered.

While this insurance policy offers speed, convenience, and immediate coverage benefits, it is essential to consider its limitations, such as coverage amounts, eligibility criteria, premium costs, and policy features, before deciding if it is the right choice for your insurance needs. Understanding these considerations can help you make an informed decision that aligns with your financial goals and circumstances.

How to Get an Instant Life Insurance Policy

The process of applying for instant life insurance is designed to be quick and straightforward, offering a convenient way to obtain coverage without the need for a medical exam or extensive underwriting. Here is a step-by-step guide based on the search results:

• Application

Instant life insurance applications are typically completed online, requiring basic information like age, gender, address, and health-related questions about past illnesses or injuries.

The application process is user-friendly and can be done within minutes without the need to speak to an agent or fill out paperwork.

• Underwriting

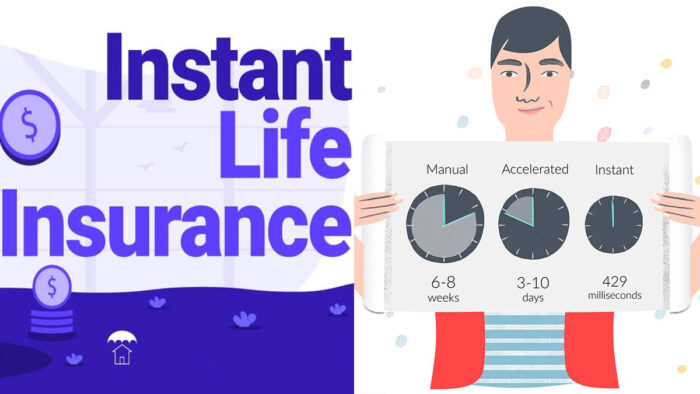

Instant life insurance policies may use accelerated underwriting, which involves algorithms analyzing data such as prescription histories and motor vehicle records to calculate risk.

Some insurers may require minimal medical records, but this streamlined process can result in higher premium costs compared to traditional policies with more extensive underwriting.

• Approval

Applicants typically receive a decision within minutes of submitting the application. Possible outcomes include approval, denial, or a referral for more information.

If approved, coverage can go into effect on the same day without the need for a medical exam.

• Considerations

Instant life insurance policies may have limitations in coverage amounts and eligibility criteria based on health and age, making them more suitable for healthier individuals under the age of 65.

It is essential to research different insurance companies before committing to one to ensure their underwriting process aligns with your needs and preferences.

Getting instant life insurance involves a seamless online application process that provides immediate coverage without the traditional hurdles of medical exams and extensive underwriting procedures. It is crucial to understand the requirements, potential limitations, and considerations before choosing an instant life insurance policy that best suits your needs.

FAQs

Is instant life insurance suitable for everyone?

It may be suitable for individuals who need quick coverage without a medical exam. However, it may not be ideal for those with complex health conditions or specific coverage requirements. It is essential to assess individual needs before choosing a policy.

What are the age restrictions for instant life insurance?

Age restrictions for this insurance policy vary among insurers but typically target individuals under a certain age bracket, such as 65 years old. Older applicants may have limited options or face higher premium costs due to age-related risk factors.

Can I customize my instant life insurance policy?

Instant life insurance policies may offer some level of customization in terms of coverage amounts and options. However, the extent of customization options may be more limited compared to traditional policies that undergo comprehensive underwriting processes.

How do premium costs compare between instant and traditional life insurance policies?

Premium costs for instant life insurance policies may be higher than for traditional policies due to the streamlined underwriting process and the absence of a medical exam. It is important to compare quotes from different insurers to find the most cost-effective option.

What happens if I am denied instant life insurance coverage?

If you are denied instant life insurance coverage, you may explore other options, such as guaranteed-issue life insurance, which typically does not require medical underwriting. It is recommended to seek guidance from an insurance professional to explore alternative solutions.