Other Structures Coverage in insurance, also known as Coverage B, is a crucial part of a homeowner’s insurance policy that provides financial protection for detached structures on your property. These structures can include fences, detached garages, sheds, gazebos, and other detached buildings.

The coverage typically pays for the cost of repairing or rebuilding these structures if they are damaged by a covered peril, such as fire, hail, wind, or vandalism.

The limit for other structures coverage is usually set at 10% of your dwelling coverage limit. This means that if your dwelling coverage is $200,000, your other structures coverage will be $20,000.

The deductible for other structures coverage is generally the same as your homeowners’ insurance deductible. This means that if your homeowners insurance deductible is $1,000, your other structures coverage deductible will also be $1,000.

Other structures coverage does not cover the contents of structures, such as tools or equipment, which are typically covered under personal property coverage. It also does not cover perils that are excluded from your homeowner’s insurance policy, such as earthquakes, floods, and normal wear and tear.

Also, it provides financial protection for detached structures on your property, with a limit of 10% of your dwelling coverage limit and a deductible that matches your homeowner’s insurance deductible. Above all, it does not cover the contents of structures or perils that are excluded from your homeowners’ insurance policy.

What is Covered by Structures Coverage in Insurance?

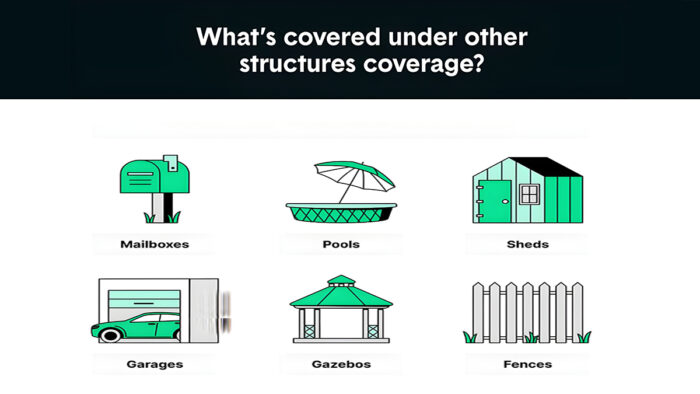

Common structures covered by other structures coverage include:

- Detached garages

- Detached patios or decks

- Driveways

- Fences

- Gazebos

- Guest houses or in-law structures

- In-ground pools

- Mailboxes or light posts

- Sheds

It’s important to note that other structures coverage protects these structures against perils such as fire, theft, windstorms, and hail damage. The coverage is typically included in standard homeowners’ insurance policies and is usually set at 10% to 20% of the dwelling coverage amount.

However, certain exclusions, like flooding, earthquakes, pest infestations, gradual water damage, and regular wear and tear, may apply. Understanding what is covered by other structures coverage ensures that detached buildings on your property are adequately protected in case of unforeseen damage.

What Isn’t Covered by Other Structures Coverage in Insurance?

While this coverage is comprehensive, there are certain exclusions that are not covered by Other Structures Coverage:

- Flooding: Damage caused by flooding is typically not covered under Other Structures Coverage. Homeowners in flood-prone areas may need to consider purchasing separate flood insurance to protect their detached structures.

- Earthquakes and Earth Movement: Most homeowners’ policies exclude coverage for damages resulting from earthquakes, sinkholes, landslides, and mudslides. Additional coverage may be necessary for protection against these perils.

- Structures Used for Business Purposes: If a detached structure on your property is used for business activities, it may not be covered under standard homeowners insurance. Additional business property coverage may be required to protect these structures adequately.

- Pest Infestations, Gradual Water Damage, and Wear and Tear: Other Structures Coverage typically does not extend to damages caused by pest infestations, gradual water damage, or regular wear and tear. These are considered maintenance issues rather than sudden perils.

Understanding what is not covered by other structures Coverage helps homeowners assess their insurance needs accurately and consider additional coverage options where necessary.

Is Other Structures Coverage in Insurance a Requirement?

Coverage B is not a mandatory requirement by law. While homeowners are not legally obligated to purchase this coverage, most mortgage lenders typically require borrowers to have homeowners insurance, which often includes Other Structures Coverage.

This coverage safeguards detached structures on your property, such as detached garages, sheds, fences, and gazebos, against various perils like fire, hail, wind, and vandalism.

The limit for Other Structures Coverage is usually set at 10% of the dwelling coverage amount. This coverage ensures that these detached structures are protected in the event of damage caused by covered perils.

While not a legal necessity, having Other Structures Coverage is essential for homeowners to ensure financial protection for detached structures on their property.

Understanding the importance of Other Structures Coverage and its inclusion in homeowners’ insurance policies helps homeowners make informed decisions about their insurance needs and ensures adequate protection for their property.

How Much Other Structures Coverage Do You Need?

Coverage B, is typically set at 10% of your dwelling coverage amount. This coverage safeguards detached structures on your property, such as detached garages, sheds, fences, and gazebos, against various perils like fire, hail, wind, and vandalism. The limit for other structures coverage is usually set at 10% of the dwelling coverage on your homeowner’s insurance policy.

However, if you have high-value detached structures on your property, you may be able to raise your other structures coverage percentage. Some companies even offer a 20% coverage option as standard.

Increasing your coverage will likely increase your cost of homeowners insurance, but additional coverage could provide you with extra peace of mind.

The amount of other structures coverage you need depends on the value of the detached structures on your property. A standard homeowner’s policy generally provides coverage for other structures at 10 to 20 percent of the dwelling coverage on your policy. If you have structures worth more than your coverage limits, you may want to speak with your insurance agent to discuss increasing your separate structures coverage.

Do I Need Other Coverage B in My Insurance?

Other structures coverage in insurance is essential for homeowners to protect additional buildings and structures on their property. This coverage provides financial security in case detached buildings like garages, sheds, fences, guest houses, or swimming pools are damaged or destroyed due to unforeseen events such as fire, vandalism, or natural disasters.

Including coverage for other structures in your insurance policy ensures that these additional buildings are safeguarded, offering peace of mind and comprehensive protection for your property. It is a valuable addition to homeowners’ insurance policies, extending coverage beyond the main dwelling to encompass all structures on the property.

Considering the potential risks and costs associated with damage to detached buildings, having other structures coverage is a prudent decision for homeowners looking to safeguard their entire property effectively.

How Much Does Other Structures Coverage Cost?

Other structures coverage in insurance is typically priced as a percentage of the total dwelling coverage amount specified in a homeowner’s insurance policy. For example, if your home is insured for $250,000, you would likely have $25,000 in other structures coverage, representing 10% of the dwelling coverage.

Similarly, with a dwelling limit of $400,000, your other structures insurance coverage would amount to $40,000, which is also equivalent to 10% of the dwelling coverage. This coverage generally extends up to 10% of the dwelling coverage amount and can even pay up to 125% of the cost to replace any covered structures beyond your home.

It serves to cover expenses related to repairing or replacing detached structures like fences, sheds, or guest houses that are not part of the main dwelling. The cost of other structures coverage varies depending on the total insured value of your home and the specific percentage allocated for this coverage in your policy.

How to Determine How Much Coverage you Need for Other Structures in Insurance

Determining the right amount of coverage for other structures in your insurance policy involves a systematic approach. Start by assessing the value of your property, including any detached buildings, to establish the total insured value.

Understanding that other structures are typically covered for up to 10% of the dwelling coverage amount listed on your homeowners’ insurance policy is crucial. For example, if your dwelling limit is $400,000, your other structures insurance coverage would be $40,000.

Additionally, consider any improvements made to your property and ensure your insurer is informed to adjust coverage limits accordingly. Reviewing your policy details and seeking advice from insurance professionals can provide clarity on the coverage needed for other structures, ensuring comprehensive protection for your property’s detached buildings and structures.

FAQs

Do detached garages need separate insurance coverage?

Homeowners often inquire about whether detached garages require additional or separate insurance coverage beyond what is provided by other structures coverage in their policy.

Are there any exclusions to what other structures coverage protects?

Understanding any exclusions or limitations to what is covered under other structures insurance is a common query among homeowners seeking comprehensive protection for their property.

Can I adjust the coverage limits for other structures?

Homeowners may want to know if they have the flexibility to adjust the coverage limits for other structures based on changes to their property or specific needs, highlighting the importance of reviewing and customizing their insurance policy accordingly.