Vandalism and malicious mischief Insurance is a type of property insurance coverage that compensates an insured for the consequences of vandalism or malicious mischief. Before looking deeply into what Vandalism and Malicious Insurance actually mean, it will be best to understand the meaning of the two key words “Vandalism and Malicious.”.

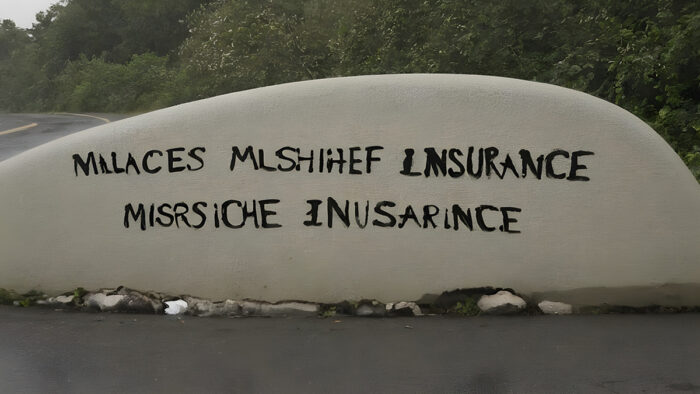

When we talk about ‘Vandalism’, it is referred to as the deliberate destruction of public or private property.” Malicious, according to the Cambridge dictionary, is the intention to cause harm by hurting someone’s feelings or reputation. On this platform, we will give you a deep understanding of all that you need to know about vandalism and malicious mischief insurance.

What is Vandalism and Malicious Mischief Insurance?

Looking at the words vandalism and malicious mischief, they are deliberate acts of destruction of someone’s beautiful or useful property done out of hatred or jealousy. Vandalism and malicious mischief could be seen as deliberate harm or destruction of someone’s property.

Vandalism and malicious mischief insurance is a type of insurance policy that offers compensation to the insured for the damages and losses incurred as a result of the act of vandalism.

It include theft of property, smashing windows on purpose, graffiti, destroying furniture, etc. The insurance helps protect policyholders from financial loss that occurs during acts of vandalism or malicious acts.

What Do Vandalism and Malicious Mischief Insurance Covers?

- This insurance covers both commercial and home-owner policies. Commercial policies such as churches, schools, and companies.

- An insurance policy that has met its deductible will be covered.

What Does Vandalism and Malicious Mischief Insurance not Cover?

- There is no insurance coverage for vandalism and malicious mischief on property, which resulted in losses and damages. The property hasn’t been occupied for close to 60 consecutive days.

- Any act of vandalism or malicious mischief caused by the policyholder himself. For example, when the owner of the property causes the destruction due to anger,.

- This insurance does not cover damages that occurred during the construction of the building.

- Any act of vandalism caused by the employees of the policyholder.

Whether you are a business owner or a property owner, obtaining vandalism and malicious insurance is very advisable, but before you eventually sign up for this, it is very important to know what you are entering into. Therefore, you need to know what this insurance covers and what it doesn’t cover, so you can get a better overview of what you are going into.

How much does Vandalism and Malicious Mischief Insurance cost?

There are a lot of considerations put in place when determining the cost of vandalism and malicious insurance, which are:

• Location and Size of the business or property

The location and size of the business or property of the policyholder are very essential in determining the price of vandalism and malicious mischief insurance. It is important to note that the bigger or larger the business or property, the higher the cost tends to be, while the smaller or smaller the property, the lower the cost of obtaining the insurance.

• The risk of exposure

The risk exposure of the business or property will also determine the cost of the insurance. Risks such as the opening and closing times of the business, the position of the property or business, the kind of customers it’s attracted, and the amount of income generated there on a daily basis

While considering the cost, the best is to get quotes from different vandalism and malicious mischief insurance companies, compare their prices, and go for the one that suits your budget.

In determining the cost of obtaining vandalism and malicious mischief insurance, there is no fixed price for all insurance companies; therefore, they have different ways of operating and how they intend to charge their customers. It is advisable to take into consideration the different types of insurance companies available and compare their prices.

Why Should I Get Vandalism and Malicious Mischief Coverage?

Just like obtaining insurance for other relevant purposes, it is also important to obtain vandalism and mischief insurance, especially if you own a property or building.

- One of the benefits of obtaining vandalism and malicious mischief insurance is that it helps protect the finances of property owners whose property has been victimized.

- It helps maintain financial stability, ensuring that the policyholder’s business can go on without hindrance caused by the damage.

- It helps implement proactive risk management strategies, which contribute greatly to the growth of the business and organization.

- Vandalism and malicious mischief coverage guarantees a quick restoration and recovery of their property to its usual state before the acts of vandalism and malicious mischief.

- They help in maintaining the company’s reputation and restoring the confidence of their customers.

- For business owners, it helps in the continuity of those businesses, therefore helping them in the continuity of their organization.

The above importance of what you are signing up for is very detailed and relevant if gone through properly, so as to know what and what gains you are likely to have when obtaining vandalism and malicious mischief coverage someday.

How to make a claim for vandalism and malicious mischief insurance

There are several actions to take when a property owner suffers damages and losses due to acts of vandalism and malicious mischief carried out on their property.

- Firstly, once the damage occurs, the incident should be reported to the nearest police station and filed in a police report case. The report case should contain information about the items and equipment’s damages in that building.

- There will be evidence to show to the insurance company. Therefore, the property owner should take pictures of the vandalized places as a means of evidence.

- The property owners should call an expert on policy adjusters in the area to help out with knowing the estimated value of the damages, which should be attached to the policy report. It is needed when submitting the claim to the insurance company.

- Once a claim has been submitted, the policyholder is expected to make sure that the insurer monitors the process of claim settlements provided in the policy document and then takes the necessary steps.

All these steps are given to guide you on how to file a claim for vandalism and malicious mischief insurance. When vandalism and malicious mischief have been carried out on your business and property, here are steps to help you file a claim and enable the insurance process.

FAQs

How can I avoid vandalism and malicious mischief?

There are several ways to avoid vandalism and malicious mischief by installing security cameras, security doors, and security windows and also working with the right law enforcement agencies in the area.

Can I add vandalism and malicious mischief insurance to my existing property insurance?

Yes, most insurance companies accept it as a means to extend protection to your properties and businesses, and it also helps cut costs by combining all insurance policies into one coverage policy.

Who Needs a Vandalism and Malicious Insurance?

If you are a business owner or a property owner, you need vandalism and malicious mischief coverage to help protect you from losses to your finances and property when an act of vandalism or malicious mischief is carried out.