Do you reside in California? Are you looking for the Capital Gain Tax Rate in California? Then you have come to the right place. In this article, I will be providing information about some of the Capital Gain Tax Rates in California. Firstly, A Capital Gains Tax is a tax put on the profit. This profit is found in the sale of a non-funded asset. In other words, Capital Gains Tax is a charge on the profit. This profit is made by an investor who sold an investment.

Furthermore, the assets could be a piece of land, coin collections, stock, business, or jewelry. In 2022, the Capital Gain Tax Rate of California has increased to 13.30%. It’s making it one of the countries with the highest capital gain taxes. It has also been mentioned that the country has scandalously high taxes and its federal taxes are 39.6%. Plus, all the capital gains in California are taxed as ordinary income. California’s capital gains or loses when an asset is sold for more or less than the amount that was spent on purchasing that very item.

How Does it work?

How the Capital Gain Tax Rate in California works is very simple and easy to understand. First, California’s Capital Gains tax is enforced on the profit that you make whenever you sell certain stocks, real estate, bonds, and assets. However, the rate is not constant and this is due to the capital gain tax being tagged as regular income.

Therefore, for you to be able to calculate your California capital gain tax, you need to be sure or rather have knowledge about your marginal tax bracket. Plus, the capital gains tax of California is charged on the exchange of capital assets. These assets need to be in California.

How Does the California Tax Capital Make Gain?

For a California Tax Capital to make again, they will need to sell an asset more than the amount that was spent on purchasing that very item. By doing this, California Capital gains are taxed when they sell the item for you at a much higher price and this will create a recognized gain.

Moreover, the Capital Gain Tax Rate in California is related to the profit that you make when you sell these assets and stocks. Plus, the capital gain tax is on the same row as California’s normal income tax laws which is from 1% to 13.3%. In other words, your capital gains taxes will move between 1% up to 13.3%. However, this is depending on your general income and matching California tax bracket.

What Are the Types of Capital Gain Tax Rates in California?

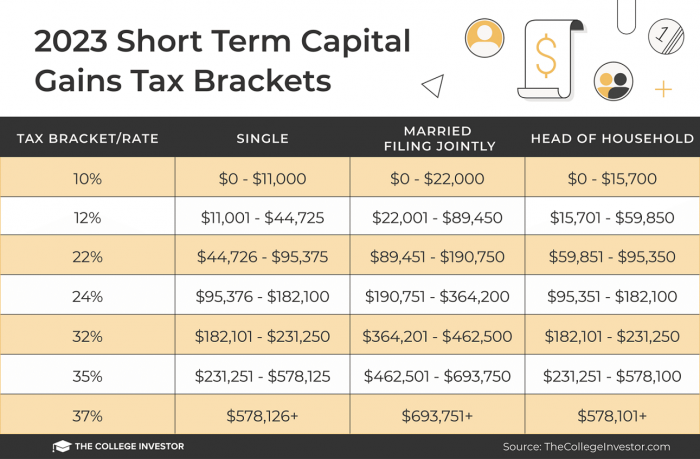

There are two types of California Capital Gain Tax rates. They include the Short-term, capital gains tax, and the Long-term Capital gains tax. The short-term capital gains tax is a type of tax that is centered on the profits that are made from the sales of an asset. This asset must have been held for one year or less before it is considered a short-term gains tax.

The Long-term gains tax is a type of tax on profits from the exchange of an asset that has been held for more than a year. Furthermore, the long-term capital gains tax rate varies from 0%, 15%, or 20%. This is also based on your taxable income and filing year.

How to Calculate Your Capital Gain Tax Rate in California

Calculating your capital gains tax is very easy. It is also straightforward and less complicated. Plus, you will need a gains tax calculator. To be able to successfully calculate your California Capital Gains Tax, follow these steps:

- Take the sale price of the asset.

- Subtract it from the cost basis.

- Note that your cost basis is the amount you paid for the asset. You also need to include the cost of any improvements that you made to it.

You also need to keep in mind that the Capital gains tax rate that you paid on your capital gain all depends on your taxable income. Therefore, you need to make use of your usual or regular tax bracket rate. With this, you will be able to calculate how much of your profit you will be taxed on between 1% to 13.3% in California.